# Affordability Assessment

# The problem

The National Credit Act specifies a set of checks that must be performed by lenders during a personal loan application process. These are:

- verify the identify of the applicant

- obtain a credit report

- retrieve 3 months bank statements, and

- perform an affordability assessment[1].

Failure to comply carries with it the threat of a judgement of reckless lending[2].

Whilst there are numerous options available for acquiring credit reports [3], there is currently no easy way to acquire and process bank transactions.

This forces lenders to hire armies of data capturers in order to manually convert pdfs and printed bank statements into usable electronic records.

Transactions provide a richer picture of a borrowers credit health than credit records do. You can accurately identify affordability criteria (income, expenses, maintenance payments, and existing credit obligations to other lenders) as well as credit risk indicators (like unpaid collection attempts, and EDO disputes).

However there are 2 key problems with transactions:

- first, they're hard to acquire: banks don't provide convenient mechanisms to access transactions from your own account let alone a 3rd parties account.

- second, they're hard to process: transaction descriptions are inconsistent across banks and payment types.

For these reasons, in many credit offices where manual data capture is used, transactions aren't scrutinized fully.

# The solution

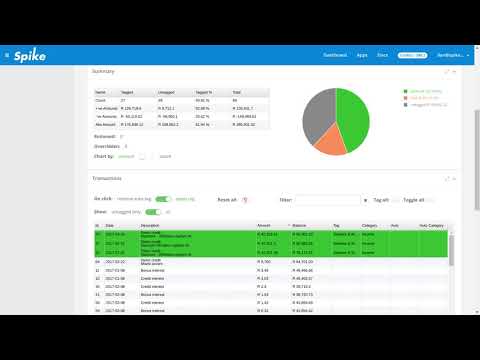

Spike provides cloud-based solutions to acquire and process bank transactions that are better, cheaper and faster than data capture. We have implemented a demo affordability assessment (opens new window) tool for use in your back-office.

# Youtube demo

You can see a video of the affordability assessment tool in action here. NOTE: the link below opens in YouTube - make sure that you have YouTube > Setting > Quality = 1080p (or at least 720p) in order to see the text in the video.

# Contact us

Contact us if you are interested in customizing this app for your use.

NCR guidelines on discretionary income (2018-04-18) (opens new window), Credit Regulations including Affordability Assessment Regulations (2015-03-13) (opens new window) ↩︎

National Credit Act 34 of 2005 : section 24 (8) (opens new window) ↩︎

the National Credit Regulator maintains a list of registered credit bureaus (opens new window) that are available in South Africa. ↩︎